Senior analyst Jamie Coutts predicts that by 2025, the market value of cryptocurrencies will grow to account for 20% of the overall market value of global technology stocks.

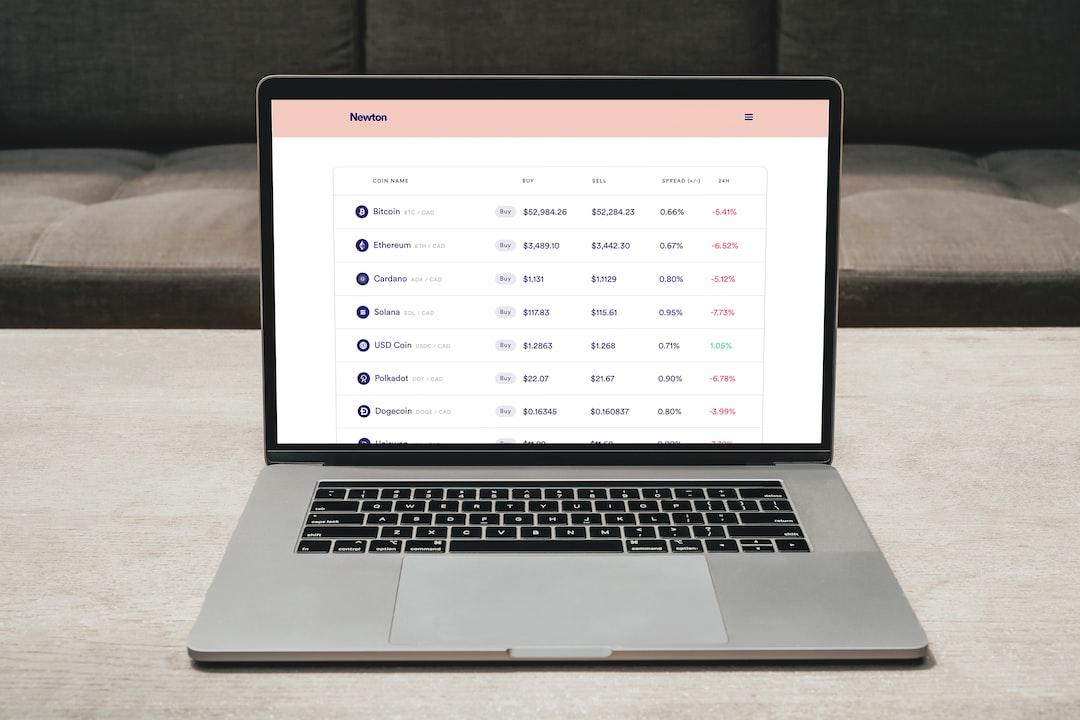

Bitcoin (BTC) has experienced a surge of over 150% in price this year, bringing the total market value of the cryptocurrency market to $1.6 trillion, with an annual growth rate of over 110%, reflecting a Bloomberg recovery in the currency market.

Regarding this situation, Jamie Coutts, who has served as an analyst at Bloomberg Intelligence for nearly a decade and now focuses on blockchain, posted on X today, stating that he believes that technology and cryptocurrencies should be the largest positions in investment portfolios for at least the next 1-2 years, until the liquidity cycle changes.

In mid-month, Coutts also commented that while altcoins are currently breaking through, the market is still dominated by the rise of Bitcoin. However, the transition to the altcoin season seems imminent, considering the significant influx of funds expected with the launch of Bitcoin spot ETFs next year. Therefore, this transition cycle may take longer, and Coutts estimates that the altcoin season will arrive within 1 to 1.5 years after the cycle low in the second quarter of 2024.

Related Reports

Don’t FOMO! 5 major data show that the market is still in the “early bull market” and the altcoin season has not yet arrived.

Bitcoin spot ETF speculation: BTC may experience a small peak and then a sharp decline, challenging the bull market only when three conditions are met.

Bitcoin to reach $250,000 in 2024! Silicon Valley venture capitalist Tim Draper: BTC’s potential rivals Microsoft.

Tags:

Jamie Coutts

Cryptocurrency

Market value

Bitcoin

Technology stocks