This article reviews the eventful year of 2023 in the cryptocurrency market. Readers of Dynamic Zone, how was your 2023? Regardless, we have all emerged strong from the chaos of the 2022 market, and Dynamic Zone just wants to say “thank you for your hard work” to all of you.

(Bitcoin ETF: Bitcoin will fall when the spot ETF is approved! CryptoQuant: BTC retraces to $32,000, investors and miners take profits)

(Bitcoin to reach $250,000 in 2024! Silicon Valley venture capitalist Tim Draper: BTC potential comparable to Microsoft)

Table of Contents:

The Emergence of Bitcoin Ordinals Protocol

U.S. Bank Failure, USDC Unpegged

PEPE: The Meme Coin Legend!

SEC’s Regulatory Blow: “Cryptocurrencies are Unregistered Securities”

Taiwan’s “VASP Guidance Principles” Passed First Reading

Friend.tech Ignites SocialFi Craze

Explosive Growth of On-Chain Texts

Conclusion

Looking back at 2023, investors in the cryptocurrency market slowly woke up from the collapse of FTX and embarked on a journey in a hazy mist. Investors have started to regain their lost faith and see a glimmer of hope in the market.

“This industry changes rapidly, a day in the cryptocurrency world is like ten years in the real world.” This year, the cryptocurrency market has experienced many ups and downs and challenges. Dynamic Zone has always stood by its readers/investors. Let’s review the exciting year of 2023 together!

The Emergence of Bitcoin Ordinals Protocol

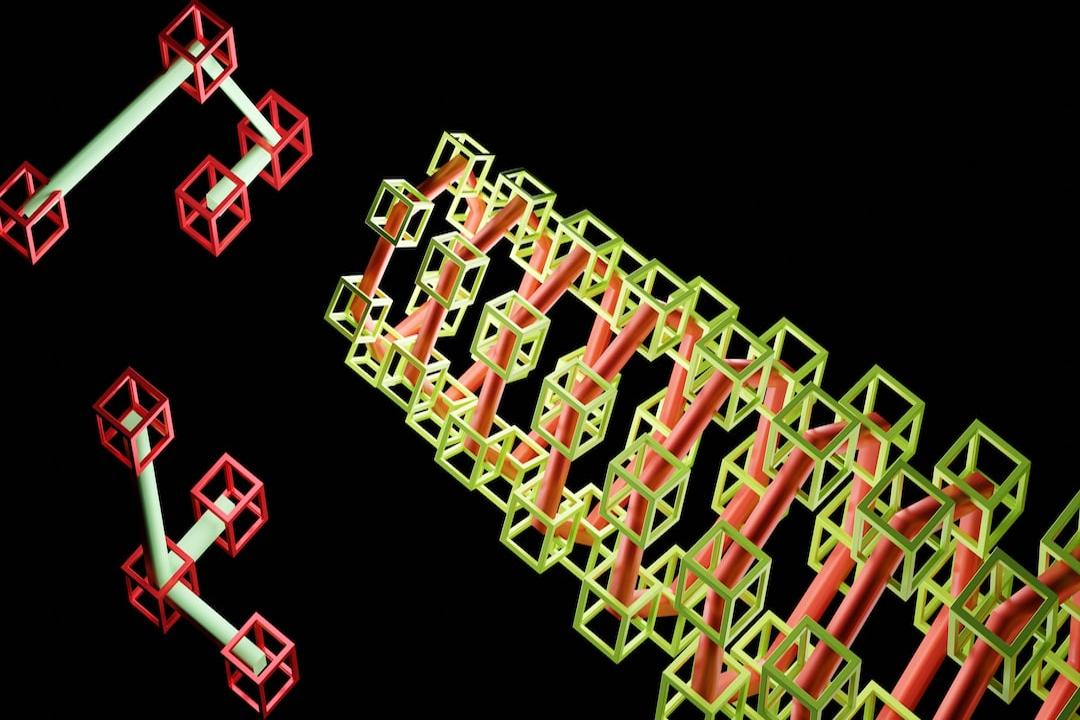

On January 21st, software engineer Casey Rodarmor introduced the Ordinals protocol on the Bitcoin mainnet. This protocol allows users to create unique NFTs on the smallest unit of Bitcoin, Satoshi (SAT). This marked the beginning of the Bitcoin ecosystem explosion in 2023.

Shortly after, based on the Ordinals protocol, Domo developed a new token standard called BRC-20. BRC-20 enables the issuance and transfer of tokens by writing text on satoshis, the smallest unit of Bitcoin. At that time, no exchanges supported BRC-20, and users had to forge their own tokens by setting up nodes. The word “text” became engraved in the entire year of 2023.

Further reading: Bitcoin NFT Craze: Ordinals Surpasses 10,000 Minted! Consuming Over Half of Bitcoin Block Space

Amidst the backdrop of global interest rate hikes, Silicon Valley Bank filed for bankruptcy and halted trading before the U.S. stock market opened on the evening of March 10th (Taiwan time). It was later taken over by the Federal Deposit Insurance Corporation (FDIC). The cryptocurrency community was concerned that Circle, the issuer of the second-largest stablecoin USDC, still had $3.3 billion of exposure at Silicon Valley Bank.

The scars of FTX’s bankruptcy were still painful, and the community quickly became worried that Circle might not be able to recover its reserves, leading to a sell-off of USDC. According to Coingecko data, the price dropped to as low as $0.878 on the afternoon of the 11th, marking the most severe decoupling in the history of USDC.

Additionally, DAI, a decentralized overcollateralized stablecoin issued by MakerDAO, also experienced panic selling as nearly 40% of its collateral was USDC. It briefly dropped to $0.886.

USDC experienced severe decoupling.

After the U.S. government intervened, the community realized that there were no major vulnerabilities in Circle’s reserves. USDC gradually returned to its pegged state of $1 after March 13th.

Further reading: Silicon Valley Bank Collapses in 36 Hours: Fed Raises Interest Rates, Sells U.S. Bonds, USDC Decoupling Crisis

In early April, the legendary meme coin “PEPE” entered the cryptocurrency market and skyrocketed within just four days, with a surge of over a thousand times. PEPE broke new highs every day, and after being listed on the cryptocurrency exchange Binance on May 6th, it reached a historic high of $0.00000431, with a market capitalization exceeding $1.5 billion, becoming the 43rd largest cryptocurrency.

PEPE’s strong upward trend led the entire meme coin market between April and May, with meme coins such as $TURBO, $POGAI, $FLOKI, $AIDOGE, etc., emerging one after another. With the rise of internet memes, the overall market entered a magical state, and many legends of getting rich quickly were created. On-chain addresses showed that many people made thousands or even tens of thousands of times their profits by entering early during this period.

Further reading: Pepe Frog Market Cap Exceeds $1.5 Billion: Whale Buys PePe for $263, Becomes $13 Million, Earning 50,000 Times!

It is worth mentioning that on April 18th, the author wrote a news article about PEPE meme coins, which became one of the leading reports in Chinese media. Unfortunately, I did not participate in it, which is why I am here writing an annual review in poverty.

Timeline moves to mid-2023. On June 5th, Binance was sued by the U.S. Securities and Exchange Commission (SEC), accusing it of violating up to 13 securities laws. The lawsuit also mentioned multiple tokens, including SOL, ADA, MATIC, FIL, etc., as unregistered securities.

The market faced the first holiday after the “regulatory crackdown,” and all altcoins plummeted. MATIC fell by 19%, SOL fell by 17%, ADA fell by 16%, FIL fell by 22%, SAND fell by 19%, etc.

Further reading: Market Plunge! Bitcoin Flash Crashes, SEC Securities Coins Drop Over 20%: ADA, SUI, AVAX, OP, TON…

At that time, the cryptocurrency market was concerned that Coinbase, Kraken, and other U.S. trading platforms would have to decide whether to delist these tokens as regulations became stricter. U.S. market makers would also be affected and might have to stop market-making for tokens classified as securities. However, Ripple and the SEC had a significant update in their legal battle over whether XRP tokens were securities in July. U.S. Judge Analisa Torres made a summary judgment, ruling in favor of Ripple and stating that Ripple’s sale of XRP through exchanges did not constitute a security.

This ruling directly weakened the SEC’s claim that almost “all tokens are securities,” and investors began to reevaluate the potential value and risks of various tokens in the market, rather than categorizing them all as securities.

In terms of cryptocurrency regulation in Taiwan, there have been significant developments this year. In September, Taiwan officially released the “Guidance Principles for Virtual Asset Service Providers (VASPs)” and the industry association preparatory group was officially established in the same month.

Further reading: FSC Officially Releases “VASP Guidance Principles”! Taiwan’s Top 10 Regulatory Focus: Ban on Stablecoins, Derivatives, Requires Bank Trust…

On the other hand, Taiwan’s first virtual asset legislation, jointly proposed by legislators Jiang Yongchang, Guo Guowen, and Zhong Jiabin, received its first reading in the Legislative Yuan on October 27th. According to Jiang Yongchang’s office, there is no timetable for the second reading of the bill, and it may not take place before the end of January 2024. Although legislator Zeng Mingzong has expressed a temporary inclination to reject the bill, this draft legislation is still an important step for Taiwan’s cryptocurrency market.

Further reading: Major! Taiwan’s Cryptocurrency Legislation Draft Passes First Reading in Legislative Yuan

In early August, cryptocurrency exchange Coinbase launched Base, an L2 chain built on Optimism technology. After its launch, the total value locked (TVL) and user numbers continued to soar. It is worth mentioning that the rapid growth of Base’s ecosystem was closely related to the popularity of the decentralized social platform friend.tech.

Further reading: What is friend.tech? How to Obtain an Invitation Code? Base’s Ecological Surge from the Decentralized Social Platform

The popularity of Friend.tech continued until mid-October, and various testnets of Friend.tech emerged on different chains. Over the course of three months, Friend.tech grew its user base to 830,000 and reached a peak TVL of $51 million. The significant trading volume also brought $23.84 million in revenue to the protocol. On October 15th, the platform reached its highest number of active users, with 73,794 users.

However, on November 12th, Friend.tech, once known as the leader of “SocialFi,” quickly cooled down, with only 1,623 active users remaining, a 97% drop. This made the market start to wonder what the true nature of “SocialFi products” really is.

Further reading: Friend.tech’s Active Users Plunge 97% in November, New Features Criticized, Is the SocialFi Craze Turning?

On November 7th, Binance announced that it would officially list Ordinals (ORDI), including trading pairs such as ORDI/BTC, ORDI/USDT, and ORDI/TRY. Due to the listing of ORDI on Binance and the subsequent surge in price, the concept coins in the BRC-20 sector, where ORDI is located, also skyrocketed. Half a year has passed, and the on-chain text racecourse has ushered in its “second spring.”

Further reading: Ordinals (ORDI) Listed on Binance Surpasses $14! BRC-20 Concept Coins Soar Across the Board

As the popularity of text-based Bitcoin continued, various major public chains such as ETH, BNB, AVAX, SOL, TIA, etc., followed the trend of text-based tokens. The “low cost, high volume, fair launch” text racecourse reached new heights. It felt like revisiting the Layer 1 moment every day, and it was also a stress test period for major public chains.

Further reading: Text-Based Tokens “Paralyze Multiple Public Chains,” Ordinals Celebration, How Long Can It Last?

Although most of the text-based projects released on various chains were memes, developers did not stop building the ecosystem during this six-month period. During this spring, we have seen the completion of projects related to text-based infrastructure, including wallets, cross-chain solutions, trading markets, minting tools, data indexing, and other products. From this, it can be seen that the third spring may await the text market.

This article reviewed the eventful year of 2023 in the cryptocurrency market. Dynamic Zone’s readers, did you personally participate in the aforementioned major events in 2023? I hope you can avoid pitfalls, profit repeatedly, and grow together with the community on the path of investment and learning.

Looking ahead to the first half of next year, we can expect narratives such as Bitcoin spot ETF, Cancun upgrade, global interest rate cuts, etc. The cryptocurrency market changes rapidly, and the only constant is continuous learning and building during bear markets and reaping during bull markets. I hope the charm of blockchain remains eternal, and we will meet at the peak!

Related Reports

Looking Back at the “Wealthy Moments” Missed During the 2023 Bear Market, What Lessons Can We Learn?

Reasons for the Surge in Ordi? Rumors in the Community Claim Binance Wallet Will List BRC-20 Text Sector, Official Clarification

Year of the Dragon Concept Coins: Besides “$Silly,” What Other Meme Coins and Texts Feature Dragon Elements?

Tags:

friend.tech

Ordinals

pepe

SEC

USDC unpegging

VASP guidance principles

Bitcoin

text