The ACE Premier Exchange fraud case was brought to court for the first time yesterday at the Taipei District Court. Yesterday morning, the alleged mastermind of the fraud ring, Lin Genghong, denied the charges when he appeared in court, claiming that he never intended to break the law. He stated that he conducted virtual currency transactions with the highest standards and strictest attitude, without any intention of committing fraud.

(A brief background:

Wei Desheng was accused of collaborating with Lin Genghong, the mastermind of the ACE fraud case, and urgently clarified: they have never met.)

(Additional background:

ACE Exchange’s Wang Chenhuan’s bail amount increased to 8 million! Fitted with an electronic ankle monitor, lamenting that “all assets are frozen” and unable to flee)

Table of Contents

Lin Genghong denies the charges

Lawyer defends lack of criminal intent

Prosecution accuses of concealing criminal proceeds

The ACE Premier Exchange collusion fraud case, announced by the Taipei District Prosecutor’s Office on April 26, has concluded its investigation and has charged 32 individuals including Lin Genghong, the ringleader of the fraud ring, former and current executives of the ACE Premier Exchange, and prominent lawyer Wang Chenhuan, with charges including organized crime, fraud, money laundering, etc. The main suspects face over 20 years in prison.

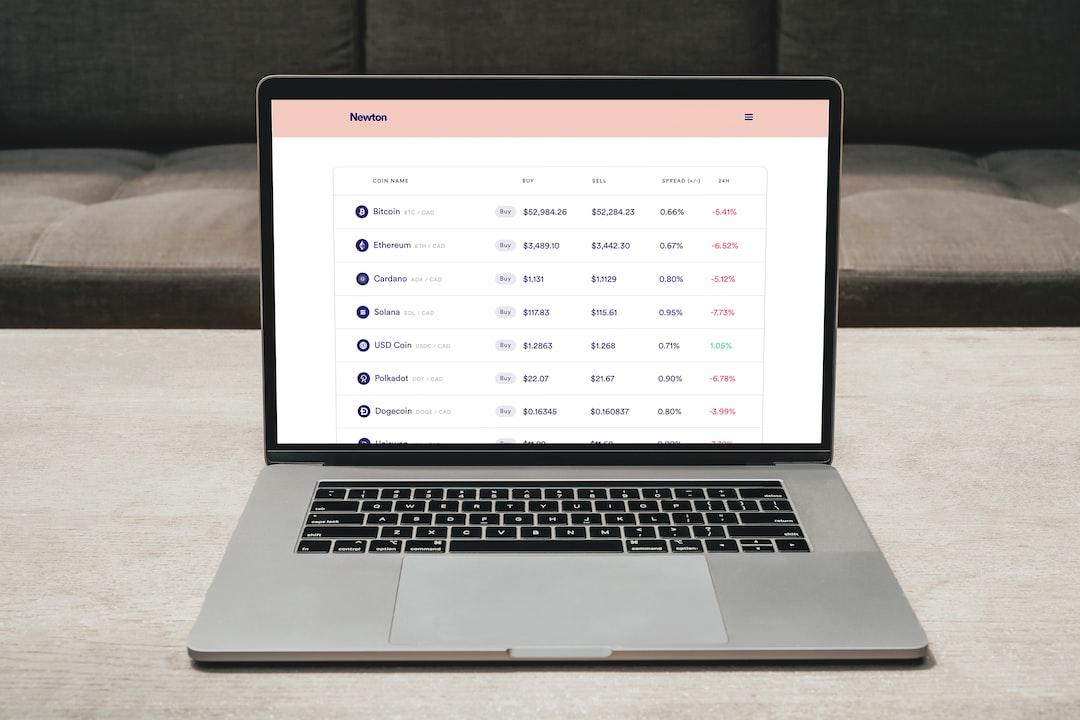

The prosecution alleged that the fraud ring has been selling virtual currencies such as MOCT, CSO, FITC, NFTC since 2019, by fabricating false investment whitepapers and selling them through the ACE and ProEx exchanges, establishing an IMBA direct sales team for promotion, and spreading fake news on online media to manipulate coin prices, deceiving 1292 victims and obtaining nearly 800 million NT dollars.

According to reports from the Liberty Times and United Daily News, the ACE Exchange fraud case had its first court hearing on the 6th. Yesterday morning, the Taipei District Court questioned Lin Genghong, who was in custody, and summoned key business executives and members of the direct sales team, including Lin Ruoqiao, while Pan Yizhang and Wang Chenhuan, members of the exchange, will appear in court at a later date.

It is understood that Lin Genghong denied the charges when he appeared in court, emphasizing that virtual currency trading is a new industry with incomplete regulations, and he had no intention of committing fraud. He explained that he knew virtual currencies could be traded but not used for fraud. Therefore, he approached the ACE Exchange, guided by KPMG, founded by Pan Yizhang’s team, and assisted by Pan Yizhang’s ABA Accelerator, which had received economic subsidies and was credible, to provide guidance on blockchain and virtual currencies for the group.

Lin Genghong stated that all executives involved or employees involved in writing whitepapers had professional knowledge, and he conducted virtual currency transactions with the highest standards and strictest attitude, aiming to innovate in virtual currencies without using fraudulent methods to deceive people.

Lin Genghong’s defense lawyer Xie Xiechang stated that the IMBA association was not established as a criminal organization for implementing fraud and there was no guarantee of profit in this case. All fund management has complete records and there was no intent to conceal or disguise.

Lin Genghong’s other appointed lawyer, Chen Weicheng, emphasized that if Lin Genghong really wanted to commit fraud, he would not complicate the facts, and IMBA is not a tightly controlled organization from top to bottom, with all chairpersons and branch heads holding only honorary titles, very different from the usual criminal patterns of fraud rings.

Lawyer Xue Qinfeng defended that the virtual currency created by Lin Genghong was not as valueless as the prosecution claimed. The prosecution must prove the lack of value of virtual currency, and sales representatives must pass exams to join the IMBA sales team, making it a challenging process. If the company wanted to commit fraud or raise funds, it would not go to such lengths.

Previously, the prosecution accused Lin Genghong of moving fraudulently obtained cash in batches to hide in Taipei and New Taipei cities, giving over 100 million NT dollars to Lin Shufen to purchase and operate the Lianchi Temple, 43 million NT dollars to Wang Chenhuan, including 26 million NT dollars as capital increase for the ACE Exchange, and another 17 million NT dollars to invest in a law firm in Bangkok, with 47.4 million NT dollars hidden by former “Innovative New Retail” general manager and special assistant to the Sanli TV media group general manager, Li Yannan.

Wang Chenhuan was charged with the role of “strategist” for teaching Lin Genghong to modify whitepapers, arranging for virtual currency exchange for physical commodities services, listing them on DEEPCOIN and UNISWAP exchanges, assigning lawyers to obtain confidential information to the fraud ring, and providing a new Zhongzheng Road house for Lin Genghong, who was on the run.

Related Reports

Former Deputy Director of Criminal Investigation Bureau suspected of being a “fraud ring consultant” under investigation by prosecutors, formerly serving as ACE Exchange Compliance Officer! Wang Chenhuan admits guilt, posts 4 million NT dollars bail; Pan Yizhang claims to be only a manager, Lin Genghong emphasizes contributions to the currency circle, both deny wrongdoing. How can victims of ACE virtual currency fraud file lawsuits for compensation? When will downstream businesses be prosecuted? Trial progress…