5 Key Factors to Staying Sane and Profitable in a Bull Market

(Previous summary: How to Get Rich in Crypto Without Relying on Luck? Financial Expert Raoul Pal Reveals His Investment Strategy)

(Background Information: 2025 Latest Cryptocurrency Taxation Rules for Investors: What are the Differences Between Domestic/Foreign Income, and Can Virtual Currency Losses Be Claimed?)

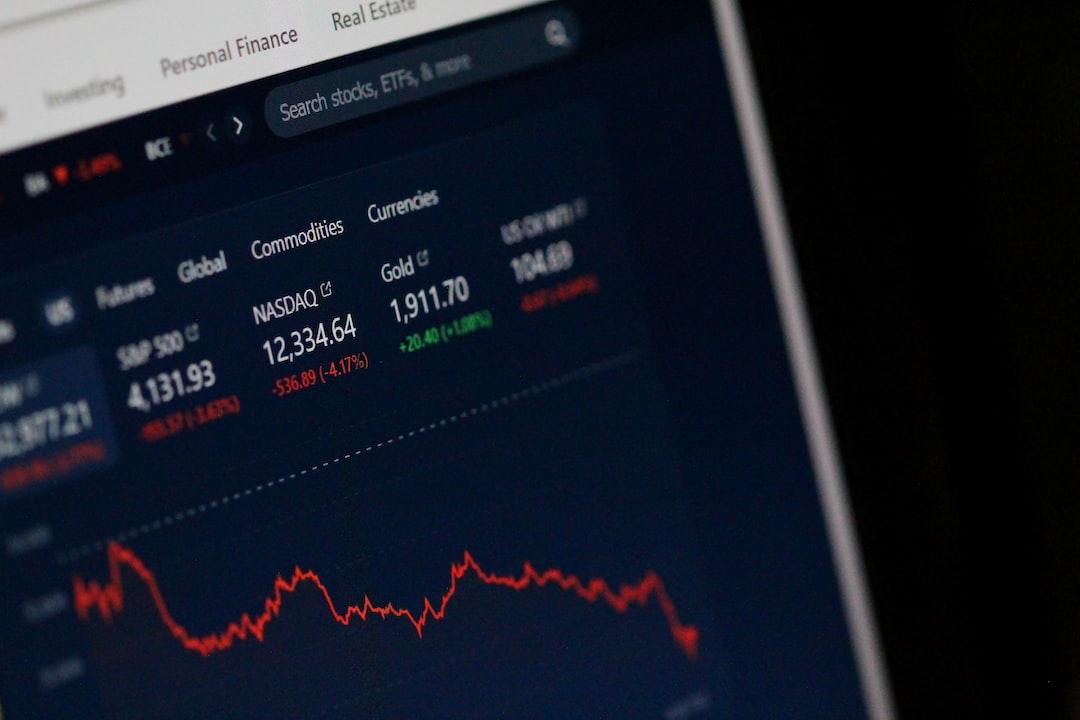

We are entering the late phase of the cycle (my personal view), which means things are starting to get really crazy. Tokens are soaring by 100 times, people are saying, “Holding BTC is meaningless,” and the trading prices of NFTs have reached absurd valuations. If this is your first or second time experiencing such a cycle, you may feel out of control. Staring at the screen all day, keeping track of what friends and family (even worse!) are saying. This article will help you manage those emotions and protect some of your gains by avoiding the “Mike Tyson-style punches” that greed can bring.

01 Mental Health in a Bull Market

1-1 Avoid Checking Prices Frequently

The simplest but most time-saving tip is: set price alerts, instead of constantly checking prices. If this is your first bull market, you might develop the bad habit of checking prices as soon as you wake up and before you go to bed. This habit indicates that you have a price at which you’re willing to buy and one at which you’re willing to sell. Understanding this, you can save at least 30 minutes each day. You won’t check prices during gym breaks, nor right after waking up or before going to bed. You’ll have a clear buy or sell price range. Given that this is the beginning of a crazy period, we speculate that most people will set buy alerts rather than sell alerts. In conclusion, set price alerts for your tokens to avoid checking prices frequently and wasting time.

1-2 Focus on Your Work and Research

99.9999999% of people will accumulate all their wealth through their business. While we focus on WiFi (e-commerce) and other online-based businesses, the core principle remains unchanged: building equity in your own business should always be the first priority. Every week, a new token soars by 100-1000%. Even in 2022 and 2023, if you were still following the space, you’d have seen such situations. If you find yourself frequently checking prices or browsing memes on X, every second spent is reducing the value you’ve worked hard to create (or could have created)! Instead, set a specific time block to search for new projects. Whether your focus is DeFi, NFTs, AI agents, or memes, we don’t mind. Everyone’s strategy is different (we’ll focus on DeFi, NFTs, and possibly RWA if BlackRock starts pushing that narrative). In conclusion, set specific time to research cryptocurrency, so you don’t neglect your cash-flow machine. When the music stops, you’ll be one of the few who can buy at a discount.

1-3 Avoid Discussing Crypto with “Regular People”

This industry has existed for over a decade. The basics are well known, and now the people entering the space have very low knowledge, sometimes not even understanding the most basic concepts. This is good for your investments, but bad for your mental health. Instead of trying to educate them, simply say: “I don’t really understand, I just hold a small amount of Bitcoin.” This will save you a lot of time. Your logic is: you only hold “the most famous coin” in small amounts, and that’s it. Now is not the time to convince others. If someone hasn’t made wealth in this cycle, the floor price will be too high for them, and they will never be able to build a position. This means you no longer need to explain “internet money” to your uncle Sal. It’s already too late for them. In conclusion, avoid discussing crypto with regular people. If they don’t even understand the difference between centralized and decentralized, there’s no need to continue the conversation. You can test their knowledge level by saying, “I don’t understand much, you explain crypto to me.” Once you hear incorrect information, end the conversation decisively.

1-4 Hold “De-risk” Assets

The problem with bull markets is that your net worth will multiply. When you reach or approach your “target number,” you’ll ask, “Where else can I invest this money?” This question leads you to continue holding, and eventually, you may lose life-changing gains on high-risk meme coins. If you don’t have a plan, you’ll lose everything. We recommend that most people allocate funds to their primary residence. Others may choose to invest in stocks, depending on your portfolio composition. Just because meme coins have risen 1000%, while the S&P 500 only rises 10% annually, doesn’t mean you should hold 100% meme coins. If you do, you’re likely to lose everything in the inevitable 99.99% crash of meme coins. In conclusion, be clear on “what this money is for.” If your only goal is to increase the numbers on the screen, you’ll likely fail in this bull market. Be clear about the specific purpose of your funds.

1-5 Don’t Neglect Health or Personal Life

I admit I’ve made this mistake many times, but it’s really not worth it. The basic measures listed above will actually help you a lot. If you set price alerts and clarify de-risk assets, you will do better than 95% of people (really). In addition, we recommend dedicating at least 45 minutes a day to exercise. Moreover, maintain normal personal life time. This varies from person to person. If you’re in your 20s, it usually means going out Thursday and Saturday nights. If you have a family, it means keeping daily arrangements with your kids/spouse or other family members. If you must choose between the two, you can reduce workout time by about 25%, but not more. If you drop from 5 days of weekly workouts to 4 days, it’s understandable. But if you drop from 5 days to 2 days, you’ll regret it.

Summary

Everyone’s life situation is different. We don’t care whether $50,000 or $50 million is life-changing for you, the principle is the same. You need a basic system to prevent yourself from going crazy. The above advice seems simple, but executing it is very difficult.

Set specific price alerts for the assets you want to buy or sell. Ensure you firmly hold onto your primary income source and continue to build your WiFi business. Allocate specific time to research new projects/NFTs, etc. The only purpose of money is to improve your life, so make sure you know what the plan is—house, car, or another specific goal. Don’t forget the meaning behind the numbers on the screen. Don’t ruin your health or personal life. You can indulge a little in the bull market frenzy, but sacrificing your health for “maybe a 10% better return” is not worth it. It’s meaningless, and when the next bear market comes, you’ll pay a heavy price (we don’t plan on riding it down with you).

02 Luck’s Rules

If this is your first time experiencing a bull market, you will likely hold through a 60-80% drop, potentially losing money (many fail due to greed). If it’s your second time, you may sell too early due to PTSD from the previous cycle.

Rule 1: Don’t Chase Round Numbers

If you’re young and your goal is $1 million? Guess what happens, you might reach $876,000 or close to that, and then the market suddenly retraces sharply. If your target is $5 million? You might reach $4.678923 million, and then a sudden 70% crash appears. And so on.

Luck doesn’t favor round numbers; this is almost a psychological form of greed. She will immediately take your wealth away.

Rule 2: Never Tell Others About Your Wealth

If you want to increase your chances of generational wealth, the goal is to tell everyone that you are poor and have nothing. If you have 10 BTC, say you have 1. If you have 10,000 ETH, say you have 100. And so on. If you’re shouting on TikTok “I told you so!!!” because a token has increased 5 times, we’re sure you’ll lose everything in the bear market, and probably more.

Except for celebrities or professional athletes, luck favors those who remain low-key. Who is Aron Landy? That’s right, most people would need to look up this name.

Rule 3: Be Happy for Any Successful Person

The vast majority of people are jealous. If you got 95 out of 100 right, they will focus on the 5 times you were wrong, not realizing that this actually proves how high your success rate is. If mistakes are rare, it means they are not the norm.

If someone made 10x on meme coins, cheer for them. If someone made 2-3x on NFTs, do the same. Jealousy or envy doesn’t help, it only lowers your luck. Luck always favors the winners. If you don’t need something, you’ll get more. If you’re always jealous or resentful of others, your luck will likely transfer to them.

Rule 4: Sell When You Feel Inflated

You may have mentioned crypto to a few people and gotten strange looks, trying to explain countless times. Even if some people understand a little and hold small amounts (like 2 BTC), they may think you’re crazy because they just jokingly bought a little but don’t really understand (otherwise they’d be crazy like you).

If your parents and friends—those who once mocked you—start saying “You were right,” it’s time to sell. Luck won’t favor those who don’t respect money.