As the U.S. presidential election approaches, Bitcoin has surged to a seven-month high, primarily driven by concerns over inflation, policy commitments, and a shift in perceptions regarding traditional safe-haven assets. This increase highlights the opportunities and challenges faced by investors.

(Related Supplement: Coincall Exchange: BTC and ETH options trading fees reduced to market lows)

(Related Supplement: Bitcoin whale holdings reach new highs! Standard Chartered: BTC will soar to $73,000 on U.S. Election Day)

**Table of Contents**

1. Bitcoin’s Election-Driven Appeal Amid Economic Policy Shifts

2. Coincall’s Flexible Trading and Enhanced Capital Efficiency Solutions

3. Maximizing Capital Efficiency Without Compromising Security

4. About Coincall

This article is a sponsored piece, authored and provided by Coincall, and does not represent the views of the editorial team, nor does it constitute investment advice or recommendations to buy or sell. Please refer to the end of the article for the disclaimer.

**Bitcoin’s Election-Driven Appeal Amid Economic Policy Shifts**

Recently, the actions of the Federal Reserve and the backing of key figures have positioned Bitcoin as a hedge against inflation. Two presidential candidates, Trump and Kamala Harris, may propose policies that increase national debt, enhancing Bitcoin’s appeal relative to depreciating fiat currencies. Trump has proposed establishing a “National Strategic Bitcoin Reserve,” while Harris’s fiscal plans add more complexity and volatility to the cryptocurrency market, providing unique trading opportunities amid electoral uncertainty.

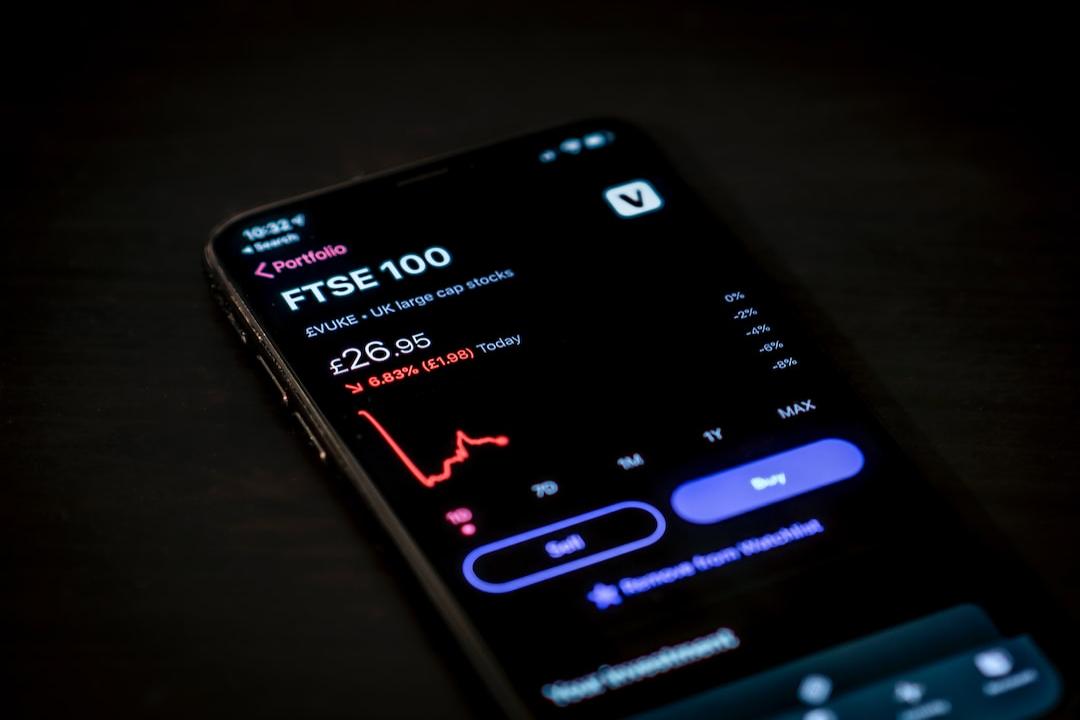

On the X platform, investors anticipate significant price volatility following the election, which has spurred short-term trading strategies. However, current centralized exchange (CEX) products have limitations. Many stable USDT yields are low, while higher-yielding products often require long-term locking of funds. This rigidity can trap capital, complicating the choice between stable income and active trading during periods of volatility.

**Coincall’s Flexible Trading and Enhanced Capital Efficiency Solutions**

As a leader in the cryptocurrency options space, Coincall has launched Call Staking, allowing users to convert their investments into trading margin without unlocking their funds. This innovation enables users to enjoy stable returns while participating in futures and options trading, creating a dual-income model that capitalizes on market fluctuations.

Coincall’s Simple Earn also offers an annualized yield of up to 13%, which is rare compared to the market average of 4%-5%. Users can easily participate by utilizing available spot balances, with one-click subscriptions and flexible redemption options. Additionally, Coincall has collaborated with Sofa to enable the Rangebound feature on the platform, bypassing on-chain conversion fees and enhancing user returns.

With Coincall’s solutions, users no longer need to choose between passive income and trading flexibility. Staked funds can serve as margin, optimizing capital utilization and creating opportunities for dual income.

**Maximizing Capital Efficiency Without Compromising Security**

In the current cryptocurrency environment, efficient capital utilization is crucial, as price fluctuations create numerous opportunities. Traditional investments often require locking up funds, which can lead to missed opportunities. Coincall enables users to maximize capital efficiency while maintaining liquidity.

At the same time, asset security is indispensable. Coincall addresses this issue by becoming the first centralized exchange (CEX) to entrust 100% of its funds to third-party custodians. By partnering with leading institutions like Copper and Cobo, and integrating Fireblocks, Coincall ensures that all customer assets are securely managed. This model not only safeguards assets but also enhances transparency, allowing traders to focus on seizing opportunities during volatile periods such as elections and significant economic changes.

**About Coincall**

Founded in 2023, Coincall is an emerging derivatives exchange that has rapidly become the world’s largest altcoin options trading platform within just one year. As a dark horse in the derivatives trading market, Coincall is committed to providing an exceptional user experience. The platform offers over ten types of altcoin options, such as ORDI, SOL, and BNB, and is known for its competitive rates in the industry. In terms of fund security, Coincall is the industry’s first centralized exchange (CEX) to entrust 100% of its funds to third-party custodians, ensuring the safety and transparency of user funds.

**Official Website:**

www.coincall.com

**X (Twitter):**

@Coincall_Global

**Sponsored Content Disclaimer:** This content is a sponsored article provided by the contributor, which has no affiliation with the editorial team. This article does not represent the views of the editorial team and is not intended to provide any investment, asset advice, or legal opinions. It should not be construed as an offer to buy, sell, or hold assets. Any services, plans, or tools mentioned are for reference only, and the final actual content or rules shall be subject to the contributor’s announcements or explanations. The editorial team is not responsible for any potential risks or losses that may arise. Readers are advised to conduct thorough due diligence before making any decisions or taking actions.

? Related Reports ?

As the U.S. presidential election approaches, what “hyped targets” can be positioned?

Gold nearing a new high of $2,800, with the U.S. presidential election and war hedging… surging more than the S&P 500; will Bitcoin be next?

With the storm of the U.S. election approaching, is the weak yen the best safe-haven asset?